author of Honorable Influence - founder of Mindful Marketing

When people think of advertising, they often envision iconic Super Bowl commercials like Budweiser’s Clydesdales playing football, model Cindy Crawford sipping a Pepsi, or basket legends Michael Jordan and Larry Bird competing at H-O-R-S-E for a McDonald’s meal. They probably don’t picture “children holding teddy bears in bondage gear.” Unfortunately, that’s the image that many people now associate with the luxury brand Balenciaga.

The century-old Spanish fashion house recently made headlines for the wrong reasons when it released a series of ads that not only featured kids posed with adult-themed props but also included photos in which appeared “paperwork about child pornography laws.”

Severe backlash against the brand has included stinging social media posts and celebrity condemnations. Balenciaga, however, is no stranger to controversy. Among its other contentious tactics have been “selling destroyed sneakers for $1,850” and “sending models who looked like refugees down the runway carrying trash bags made of expensive leather.”

The company has apologized for its latest gaffes, with representatives saying that they take “full accountability for our lack of oversight,” as well as that they are “closely revising our organisation and collective ways of working.” Balenciaga’s creative director Demna also offered a mea culpa, saying that it was "inappropriate to have kids promote objects that had nothing to do with them."

It would be convenient if Balenciaga could be considered some kind of an advertising anomaly, but unfortunately, over the years, other companies have made their own promotional blunders, some arguably as bad or worse than that of the high fashion firm, for instance:

- Dove created a campaign in which Black women pulled their t-shirts off over their heads, transforming into white women.

- Reebok put up posters that read “Cheat on your girlfriend, not on your workout.”

- In a commercial called “Pipe Job,” Hyundai used a man’s failed suicide to show that its vehicle produced no harmful emissions

- A line-up of uniformly thin young female models served as the central visual for Victoria Secret’s “Perfect Body” ad.

It’s easy to scoff at these ads and think, “How could those companies be so rash to release such obviously offensive advertising?” “Couldn’t anyone see the probable PR crises and pump the brakes?”

Of course, hindsight is 20/20, and it’s easier to criticize than it is to create. It’s also hard to know the circumstances surrounding the decisions. Still, here are two misguided motives that probably contribute to what seems like a never-ending series of advertising missteps:

1) Coveting Awards: The goal of any advertising should be meaningful ROI for the client, e.g., brand building, website views, sales. However, those practical objectives can fall prey to creative staffs’ desires to win advertising awards like Clios and Webbys.

To achieve such recognition, some advertisers feel needs to test social norms and push moral envelopes. Meanwhile, consumers sometimes see uber-creative ads but when asked what they’re for, they respond, “I have no idea.”

2) Creating Buzz: Relatively few advertisers compete for major industry awards, but millions would love their organization to be the focus of the next viral video. Unfortunately, the very unique content that people love to share with friends on social media is often not what translates directly, or at all, to bottom-line advertising results.

Worse, things like sexually explicit images may stimulate thousands of shares, but they also have negative impacts on social issues such as body image and gender stereotypes and ultimately backfire on the firms’ brand images.

Those are two of the most likely reasons why morally questionable advertising occurs, but what can be done to avoid it? Here are four strategies that can help:

1. Create a culture of questioning: People at all organizational levels need to feel they have the freedom to ask things like, “Could some people find this offensive”? or “Is there approach that would be equally effective but less risky?” If employees worry they’ll be shunned or punished for raising a red flag, those kinds of questions will seldom arise.

Crafting such an open culture is much easier said than done, but a few necessary prerequisites are top management support, rewarding people for asking hard questions, and continually reminding associates of the desire for moral accountability.

2. Identify corporate values: One of the best reminders of where a company stands ethically is a clearly articulated set of moral standards. Some companies suggest such principles in their mission statements. Other firms go a step further and outline a list of corporate values, such as these that form the foundation for Mindful Marketing:

- Decency: avoiding behavior that people tend to regard as crude, heartless, immodest, obscene, profane, or vulgar

- Fairness: treating others equally based on their personhood and equitably based on their individual contributions

- Honesty: not lying or distorting truth

- Respect: holding others in high regard

- Responsibility: fulfilling duties to others, especially those that society tends to marginalize

3. Avoid time pressure: Given that most of us don’t do our best work when rushed, a hastily created ad campaign will likely suffer the same results. It’s helpful when there’s time to put new work aside and return to it several hours, days, or weeks later with fresh eyes that can then more clearly see any shortcomings.

Similarly, it’s much better to identify serious deficiencies, moral or other, early in the process. People increasingly resist change as more effort and expense are invested. It’s best to nib potential ethical offenses in the bud.

4. Ask for assistance: After we’ve been exposed to something for a period of time, it becomes harder to see it objectively. In fact, we may even forget about the thing, like a painting on the wall of our home, until a visitor’s comment reminds us it's there.

For any significant work, it’s very helpful to ask others to review it. Inevitably, they’ll see things we missed. For an ad, that should mean at a minimum of others outside the department or division, and perhaps someone outside the organization. Companies ask consultants to advise them on all kinds of business strategies. Given the havoc that an ill-conceived ad campaign can wreak, they also should ask outside experts for ethical input.

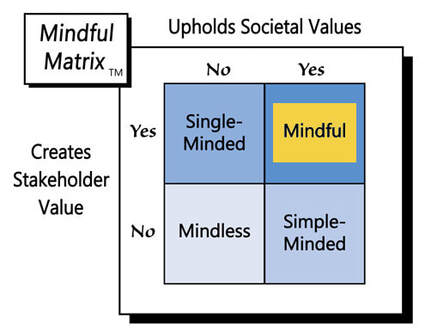

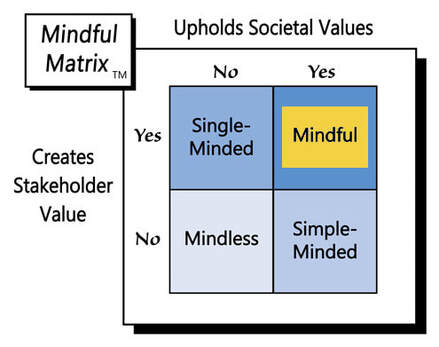

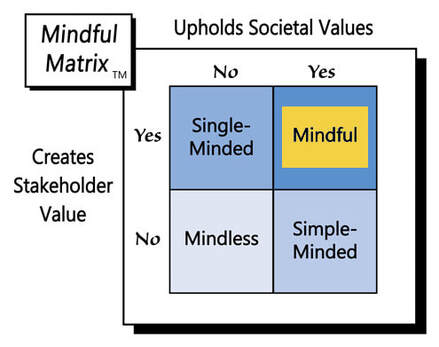

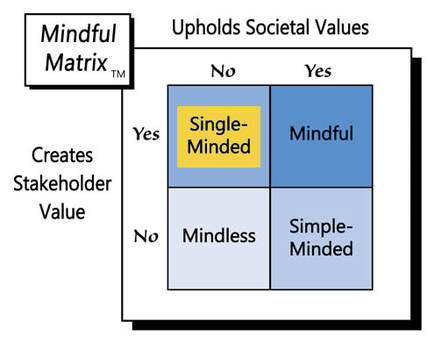

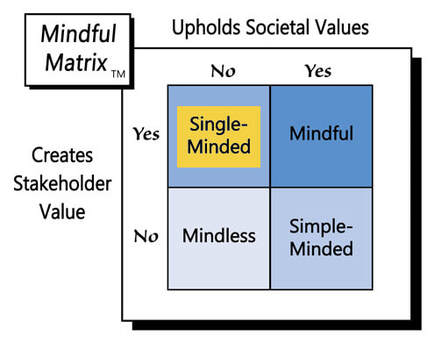

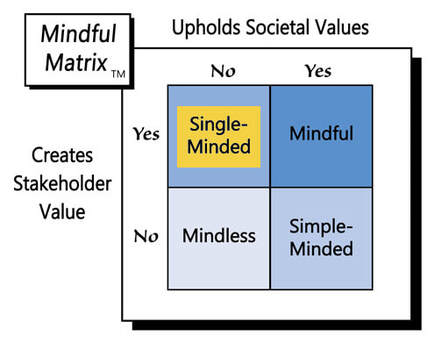

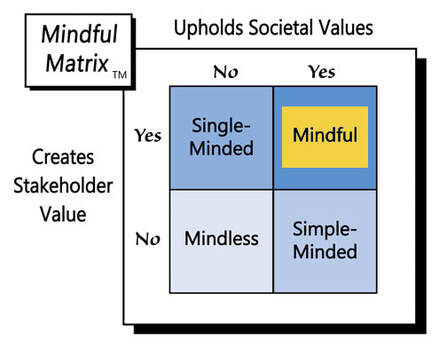

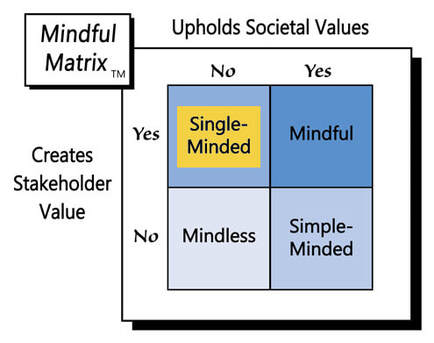

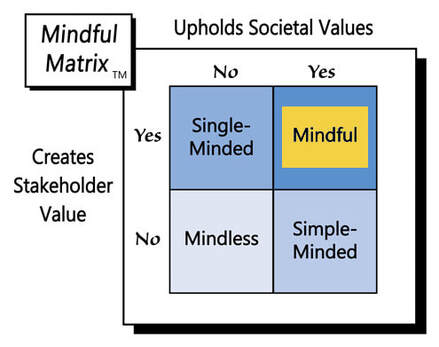

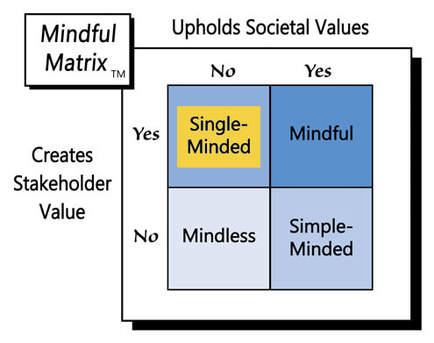

Balenciaga wasn’t the first and, unfortunately, won’t be the last advertiser to overstep moral boundaries. However, steps like those above can guide firms around ethical infractions. Making morality an advertising priority alongside creativity is “Mindful Marketing.”

Learn more about the Mindful Matrix.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed