About 5,300 Wells Fargo employees have been implicated in setting up the fake accounts, many of which were based on the information of real Wells Fargo customers. Over a period of several years, low-level bankers and tellers did things such as moving funds from customers’ existing accounts to fabricated ones “without their knowledge or consent.” These schemes resulted in some customers incurring a variety of unwarranted charges, including overdraft fees because their actual account balances were lower than they should have been. In other cases, Wells Fargo employees created “phony PIN numbers and fake email addresses to enroll customers in online banking services.” They also set-up 565,000 fake credit card accounts.

Those 5,300 employees have been fired, Wells Fargo has been fined $185 million, and the company has agreed to refund customers $5 million, but those remedies haven’t stopped the outrage over the illicit acts from spreading to persons not directly affected, including members of Congress who have grilled Stumpf about his role in the scandal. Some have compared Wells Fargo to Enron and suggested that the CEO is running a “criminal enterprise,” which should land him behind bars.

Stumpf, who is forfeiting at least $41 million in compensation as a result of the scandal, has apologized, saying he is “deeply sorry” for Wells Fargo failing its customers. At the same time, he has “rejected lawmakers’ attempts to cast the scandal as a consequence of broader failings in Wells Fargo’s leadership and corporate culture.” Instead, he has suggested that the 5,300 former employees each suffered from an individual ethical lapse.

How could over 5,000 people working for one company just happen to make the same moral mistake? The fact that so many precipitated the swindle, in the same organization, over a relatively short period of time, suggests that either something was being done to encourage the fraud, or there was a glaring lack of control for preventing it.

Some have suggested that the company’s product sales goals may have encouraged employees to fabricate accounts in order to meet their quotas. Although overly-aggressive goals could have contributed to the corruption, it’s unlikely that such a system was the sole cause. Many companies provide their salespeople with performance-based incentives, yet they don’t make-up orders. There must have been either other institutionalized efforts to cheat or shared negligence in preventing it.

However, whatever the corporate compromises were, they don’t absolve the individuals directly responsible for the fraudulent acts. In other words, Stumpf was right to suggest that there were thousands of individual ethical lapses—there had to be in order for the problem to multiply the way it did.

Each Wells Fargo employee who opened a fake account, borrowed a real customer’s email address, or invented a PIN, knew that what they were doing was wrong. It would have been impossible for them not to. Banking requires mental acuity, and a company doesn’t become the fourth largest in a very competitive industry without hiring sharp people.

Of course, cognitive ability doesn’t always translate into moral sensitivity; however, no Wells Fargo employee should have missed one major moral standard: “Do unto others as you would have them do unto you,” or, treat others the way you want to be treated. Virtually everyone can understand and appreciate the Golden Rule, which is found in every major world religion.

At some point, each person who participated in Wells Fargo’ sales sham must have thought to themselves, “I’m creating a fake account for someone, which will cost them money, compromise their identity, etc.; I wouldn’t want anyone doing that to me,” yet they went ahead and did it anyway. Did a corrupt corporate culture or misplaced incentives encourage or pressure employees to make the wrong choice? Probably. Still, each individual had a choice. Even if doing the right thing came at great cost to them, e.g. their job, that alternative should have been preferable to intentionally harming others and sacrificing their personal integrity.

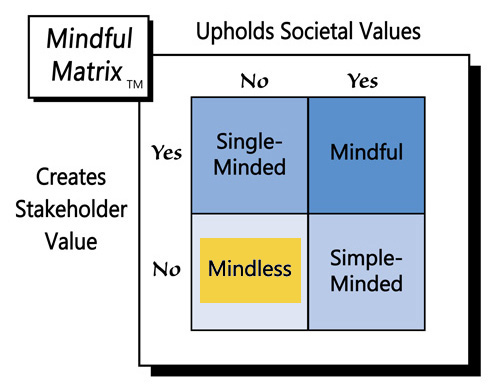

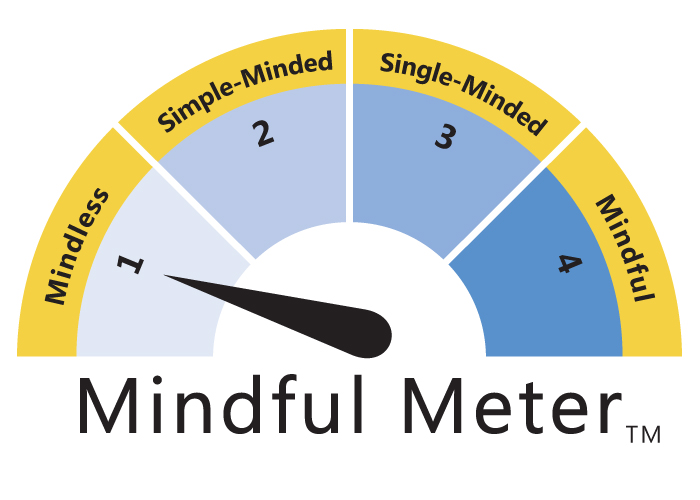

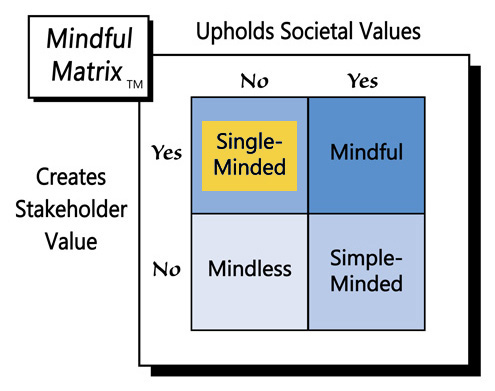

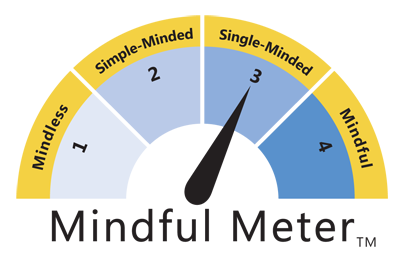

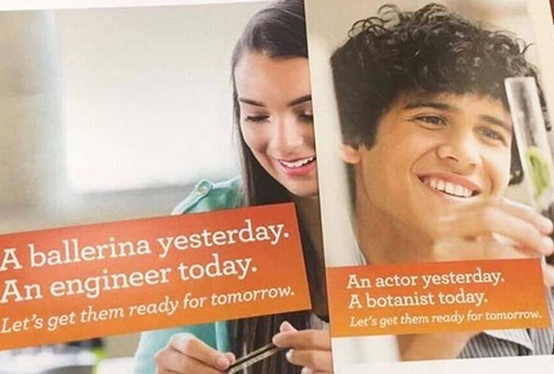

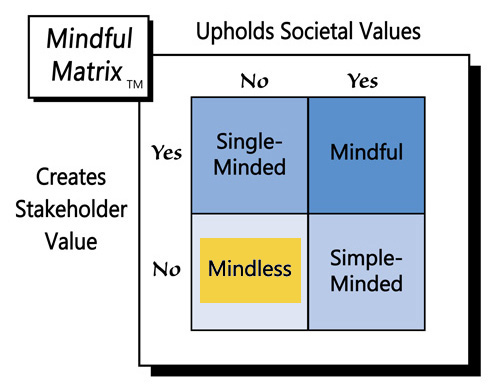

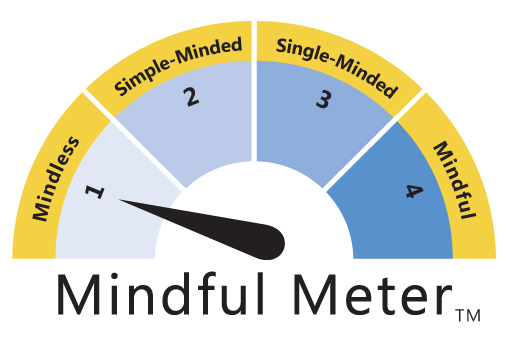

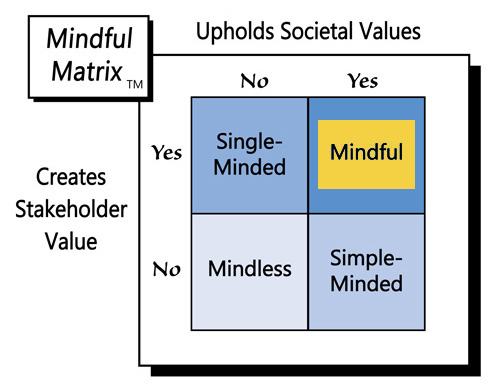

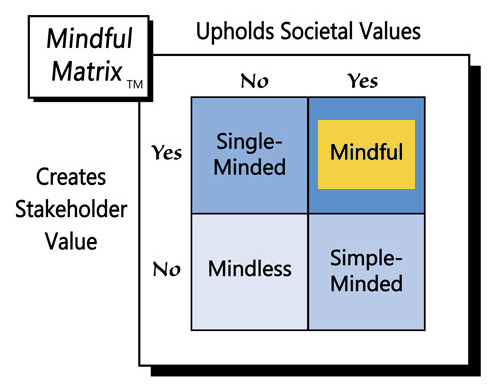

Poor company policies and individual impropriety both likely led to Wells Fargo’s sales scandal. Regardless the cause, creating fake accounts cost stakeholders’ value and compromised societal values like fairness and respect. Consequently, all those responsible, from the bottom up, are answerable for “Mindless Marketing.”

Learn more about the Mindful Matrix and Mindful Meter.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed