author of Honorable Influence - founder of Mindful Marketing

The recent Masters Tournament seemed like a success, including that it crowned its first Asian-born champion, Hideki Matsuyama of Japan. However, “a tradition unlike any other” also showcased some cringe-worthy commercialism that led to the son of an all-time golf great losing permanent access to Augusta.

Perpetuating the Tournament's prestige, Masters’ organizers invited three of golf’s living legends to serve as honorary starters: nine-time major champion Gary Player, 18-time major champion Jack Nicklaus, and Lee Elder, the first African American to play in the Masters. It was at that ceremonial tee shot when the uninvited endorsement occurred:

“While Elder was receiving the accolades of Augusta National and surrounding patrons, Wayne Player, serving as his father's caddie, stood behind Elder clearly holding a sleeve of OnCore golf balls in such a way as to give the logo maximum visibility.”

Wayne Player has a relationship with OnCore Golf that includes serving as Tour Commissioner of the Player Amateur Tour, for which the golf ball brand is the title sponsor.

Social media quickly condemned Wayne Player’s “guerilla marketing,” calling the tactic “an embarrassment” and “undignified,” and suggesting he hijacked a special moment to “sneak in a free ad for golf balls.” Masters organizers apparently didn’t like the ambush advertising either: They’ve reportedly banned Wayne Player from the Tournament for life.

Those are harsh criticisms and consequences, especially given that considerable commercialism already surrounds the Professional Golfers’ Association of America (PGA) and the Masters.

The PGA’s Partners’ webpage reads like a Who’s Who List of corporate sponsors. “Official Partners” include the likes of AIG, Charles Schwab, Cadillac, John Deere, KitchenAid, KPMG, and Rolex. Then, there’s a whole other list of “Golf Retirement Plus Partners.” In total, 54 companies can claim they support the PGA.

For its part, the Masters Tournament’s website contains logos and links for its three marquee sponsors, AT&T, IBM, and Mercedes, who reportedly treat invited guests to an incredibly indulgent tournament experience, all charged to their corporate accounts.

What may be even more noteworthy is that the golf balls Wayne Player held were far from the only promotion present at the ceremonial tee shot. Gary Player wore a PXG hat, whose golf clubs he endorses, and a Black Knight shirt—his own signature brand. Similarly, Nicklaus came outfitted in a bright yellow sweater and matching hat, both bearing his Golden Bear brand. Elder also wore branded apparel: a PNG hat and a TravisMathew shirt—the latter is part of a formal partnership with Elder that the company announced just days before the Masters.

Given all of the corporate/self-promotion already present at the starting tee, what was wrong with Player strategically displaying one small sleeve of golf balls?

There are two main reasons Player’s product placement was ill-advised:

- It was unnatural: It’s typical for golfers and others to will wear branded apparel on golf courses and elsewhere. It’s strange, however, to see someone hold steadily a sleeve of golf balls precisely so its logo appears prominently in camera shots. That’s why when product placement is done well in movies and TV shows, the products don’t draw attention to themselves; rather, viewers simply see them as part of the scene, if they notice them at all.

- It was uninvited: The very unique Masters moment belonged to Gary Player, to Nicklaus, and especially to Elder. No person or thing should have stolen the spotlight from them, at least not without the Masters’ express permission. Ultimately, Wayne Player pulled a Michael Scott, showing little social awareness and, instead, surmising that the situation should be about him, not just the others.

So, the next time you’re a caddie at the Masters . . . of course, that’s a situation most of us will never experience, which makes it even more tempting to point a finger at Wayne Player, shake our heads, and wonder how he could act so insensitively. The problem, though, is that the proliferation of social media has made it exceedingly easy for any individual or organization to do the same sort of thing and steal others’ spotlights.

On a corporate level, such commandeering might take the form of a company donating $10,000 to a worthy social cause, then spending $100K to brag about its kind-hearted contribution in TV commercials, print ads, and other media.

Individuals also are not immune. We should be especially careful not to steal the spotlight with one upmanship. For instance, when a friend or colleague shares a special accomplishment on social media, we shouldn’t ‘congratulate’ them with a reply like, “I’m so happy for you. I remember when I completed my first 5K three years ago. Now I’m getting ready to run my fourth marathon.”

A few years ago, the American Marketing Association published a piece I wrote about the “Three C’s of personal branding.” In the article I argued that communication, which is what many people solely associate with branding, should only be the “icing on the cake.” A strong personal brand, or corporate brand, must first include a foundation of “cake”: character and competencies.

When we steal another’s spotlight and try to make their moment ours, we not only misplace our personal marketing communication, we reveal the serious character flaw of callous self-absorption, which is very destructive to any brand.

No self-promotion should come at others’ expense. In fact, the best self-promotion actually benefits others.

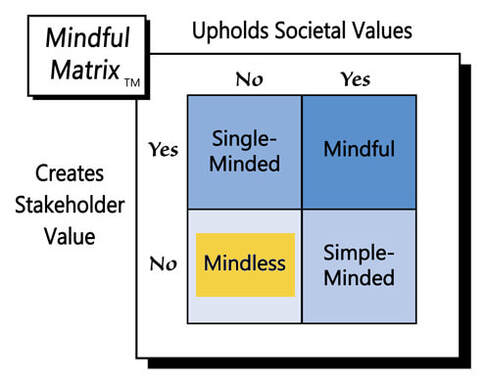

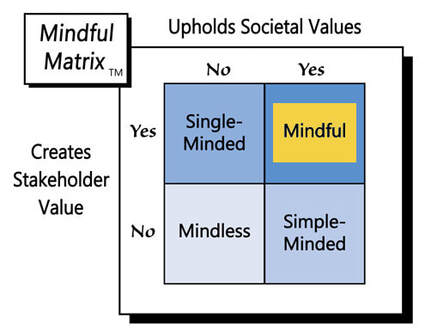

It’s easy to argue that Wayne Player’s golf ball product placement at the Masters was a bad idea. It’s also easy for any of us to succumb to similar temptations in everyday situations and make another’s moment our own. Pulling a Wayne Player, or a Michael Scott, makes any of us guilty of “Mindless Marketing.”

Learn more about the Mindful Matrix.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed