author of Honorable Influence - founder of Mindful Marketing

The introduction of almost any new Apple product, particularly an iPhone, is newsworthy. Even people who don’t buy Apple are interested in the features the firm unfurls in its latest phones. This time, though, it’s what Apple hasn’t included that’s made headlines.

The iPhone 12 packs many impressive features including an A14 bionic chip, an edge-to-edge OLED display, a ceramic shield, and night mode, but consumers won’t find in the box two items they’ve come to expect with any iPhone: EarPods and a charging adapter.

Given that many people are particular about what they put on/in their ears, and some wanting wireless, it’s not surprising that Apple decided to forgo ear accessories with its new phone models. What is surprising, though, is that the iPhone 12 comes sans charger—something everyone needs in order to use the product.

A main reason Apple has omitted the charger is that it believes people already have one, which probably is true for many of those interested in the latest iPhone. At the same time, if someone is willing to pay $800+ for the base model iPhone 12 or $1,000+ for one of the Pro versions, shouldn’t Apple oblige by including a comparatively inexpensive power supply?

Apple’s omission has challenged me to think of precedents for such a strategy, which seems akin to an automaker selling cars without spark plugs. As suggested at the onset, some companies market toys and other low-end electronics with the package disclaimer “batteries not included,” but that’s increasingly rare. Plus, batteries are inexpensive and easy to find . . . at least most are, which reminds me of a shopping experience I had a few months ago.

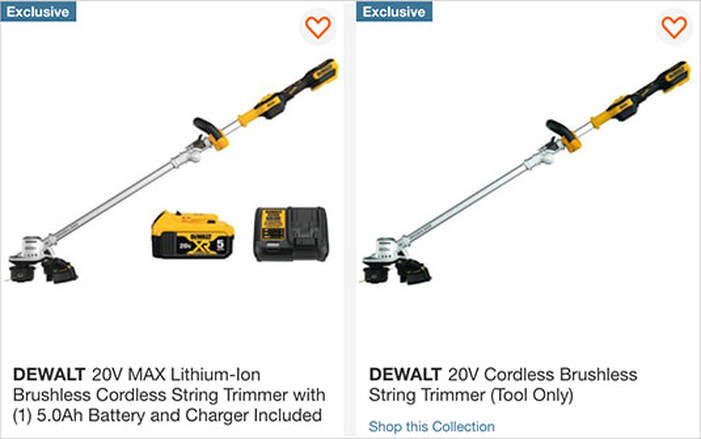

With both my gas-powered leaf blower and string trimmer on their last legs, I started searching for battery-powered replacements. In the process, I noticed several units labeled “tool only,” which were often priced $100+ less than what looked like the same models. I soon realized that some people only buy the implement because they already have one or more batteries and chargers from prior purchases of tools that use the same power system. For those individuals, the manufacturers’ “unbundling” of the battery and charger from the tool is a big benefit.

We’re used to seeing companies bundle products, i.e., market related items together and, in doing so, offer consumers an overall lower price, e.g., value meals at fast food restaurants, home and auto insurance policies. Unbundling is the opposite: A company realizes that consumers dislike paying for products they don’t want/use, so it deconstructs the bundle and sells products separately, usually at somewhat higher individual prices.

There’s a significant cost difference, however, between power supplies for yard tools and those for iPhones. A battery and charger accounts for about half the price of a yard tool package, while the phone charger represents just a fraction of an iPhone’s cost.

That discrepancy suggests that, unlike most unbundling strategies, Apple’s approach was not driven by consumer’s desire to save money. Lisa Jackson, Apple’s vice president of environment, policy, and social initiatives explained how the company had, instead, sustainability in mind:

"There are also over 2 billion Apple power adapters out there in the world, and that's not counting the billions of third-party adapters. We're removing these items from the iPhone [12] box, which reduces carbon emissions and avoids the mining and use of precious materials."

Apple’s website elaborates on the environmental ends the company aims to accomplish by omitting the iPhone 12 charger:

- Carbon savings equal to 450,000 fewer cars on the road per year

- Reduced mining and use of precious metals

- A smaller phone package, allowing more boxes per shipment and fewer overall shipments

- The elimination of 2 million metric tons of carbon emissions each year

Those intentions are certainly admirable. It’s questionable, though, if that projected positive environmental impact will actually occur, given that consumer behavior will likely adjust as a result of the iPhone 12 coming without a charger.

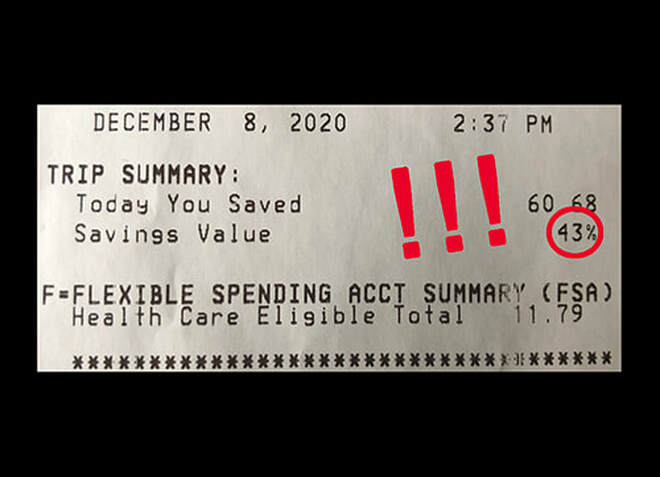

Of course, some iPhone 12 buyers won’t have a workable adapter and will have to buy one, either from Apple or a third party. However, even if customers already own a serviceable power supply, they still might decide to buy a new one for one or more of the following reasons:

- If they sell or gift their old iPhone, the recipient will probably want the charger.

- It can be convenient to have more than one charger (e.g., one for home, one for work).

- Consumers don’t usually want to use old accessories with new products. For instance, few people want to put used tires on a new car or old laces in new shoes.

- The old chargers are not completely compatible with the newest iPhones. Although one can connect an iPhone 12 to an old power adapter using an old lightning to USB-A cable (the USBs with the large, wide connectors), the new iPhone won’t charge as fast as it will by plugging the included lightning to USB-C cable (small, compact connector) into a new adapter, purchased separately.

In sum, many people will still want or need to buy an adapter, which “will now need to be packed and shipped separately from the phones, thereby increasing the environmental consequences.”

The change in buyer behavior is coupled with the fact that chargers from smartphones, tablets, etc., account for a very small percentage of all e-waste. Ruediger Kuehr, head of the Sustainable Cycles (SCYCLE) Programme hosted by the United Nations University, estimates that Apple’s move could save at most 25,000 metric tons, or .05 percent of annual e-waste.

Granted, any e-waste avoided is a good thing, but the packaging and transportation costs from secondary market charger sales could erase some or most of the environmental gains of keeping the charger out of the original package.

Apple is an environmentally-conscious company with a continually-improving track record for sustainability, which includes reducing toxic components in its hardware, nearing 100% use of recycled materials in its phone manufacturing, and aiming to be carbon neutral by 2030.

Still, omitting an iPhone 12 charger doesn’t promise to be the “boon to the environment” that the company has suggested.

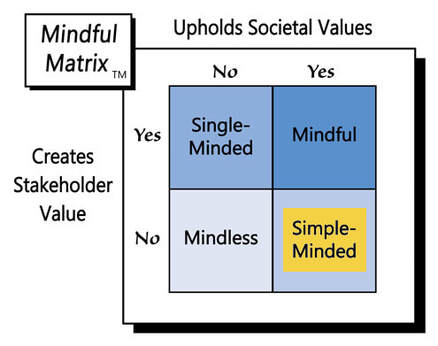

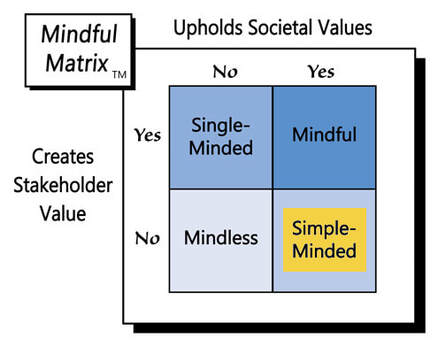

Apple’s unbundling was likely well-intended, but the reality of little environmental impact and negative consumer reaction, makes the strategy a case of “Simple-Minded Marketing.”

Learn more about the Mindful Matrix.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed