Whether you realize it or not, you probably know someone who is at high risk of anaphylaxis, “a potentially severe or life-threatening allergic reaction” that happens within minutes of exposure to a specific allergen. A wide of variety of items can trigger such potentially fatal reactions, for instance: latex balloons, biting or stinging insects (e.g., bees), and certain medication, such as penicillin. The most prevalent and perilous trigger for anaphylaxis, however, is food in the form of such common edibles as peanuts, shellfish, milk, and eggs.

It’s believed that as many as 15 million Americans have food allergies, which have increased dramatically in recent decades among children. In fact, “every 3 minutes, a food allergy reaction sends someone to the emergency department,” and children under age 18 alone account for over 300,000 food-allergy-related ambulatory care visits each year.

When at-risk individuals contact their allergens, they have only a matter of minutes to receive treatment before potentially fatal symptoms spread. That treatment should involve a trip to a hospital emergency room and a shot of epinephrine, a chemical that counteracts the tightening of blood vessels and relaxes the muscles of the airways. Obviously two or three minutes are not nearly enough time for most people to reach a hospital, so enter a genuine life-saving device, Mylan’s EpiPen.

EpiPens are life-savers because they provide a portable, measured dose of epinephrine: A standard EpiPen contains .3 mg of epinephrine, while an EpiPen Jr. has half the dosage (.15 mg) for smaller children. At the first sign of symptoms, the EpiPen is struck against a person’s outer thigh and held in place for 3 seconds, allowing the epinephrine to enter the body and stemming the symptoms until the person can receive professional medical treatment.

So, what’s the price of this potentially life-saving device? Mylan has chosen to charge consumers $600 for a two-pack of EpiPens. On one hand, the price seems like a bargain—a few hundred dollars to save one’s life is a small price to pay. On the other hand, in 2009 a similar two-pack cost just $100, a price increase of 500% in about 7 years.

Of course, many products increase in price over time—that’s the nature of inflation. It’s virtually unheard of, however, for a product to rise in price so much so fast, especially when most other prices are holding steady. During the same time period U.S. inflation, as measured by the Consumer Price Index (CPI), ranged from a high of 3.16% in 2011 to a low of 0.12% in 2015, yielding an average inflation rate of just 1.39% for the seven year period.

Those types of macro comparisons can be helpful, but they don’t tell the whole story. If for some reason raw materials or other specific production costs rise precipitously, a manufacturer has no choice but to hike its prices. That scenario, however, doesn’t describe Mylan’s cost structure. Experts in the pharmaceutical industry estimate that one EpiPen likely costs Mylan $30 and might run as low as $20 per pen. Of that total, the epinephrine costs only $1 and the injector parts just $2-$4. The balance goes to manufacturing royalties.

Even if these estimates are low or other costs need to be added in, Mylan would appear to easily clear over $200 per device. That kind of profit margin in conjunction with huge price increases is likely to upset many consumers. Add the fact that EpiPens have shelf-lives of just 18 months and that users, many of whom are children, have few or no alternatives to the life-saving product, people become understandably angry, including those in Congress.

On September 21, the House Oversight Committee summoned Mylan CEO Heather Bresch to Washington to testify about EpiPen’s unseemly price increase. As expected, legislators lambasted Bresch, but she held her ground, suggesting that the “‘complexity’ of the health-care system” misrepresented Mylan’s real profit margin, which she claimed was a more modest $50 per EpiPen. This estimate didn’t exactly reconcile with another statement Bresch gave on CNBC in which she suggested that Pharmaceutical Benefit Managers (PBMs) were capturing much of the profit margin, and Mylan’s intake was about $275 per twin-pack of EpiPens.

Healthcare intermediaries do also affect price; although, Mylan’s actions appear to have had by far the biggest impact. It’s also important to note that those at risk of anaphylaxis have other options: Amedra Pharmaceuticals makes a similar product called Adrenaclick, and there is a generic epinephrine auto-injector. One must wonder, though, about the availability and/or viability of these alternatives, given that most consumers haven’t heard of them and, according to Mylan, EpiPen “has been the most prescribed epinephrine auto-injector in the U.S. for more than 25 years.”

In a free market system, suppliers are able to set the prices they want, and buyers are welcomed to pay them, or go elsewhere. Likewise, no individual or organization is obligated to make epinephrine injectors or any other product. So, is Mylan any more answerable for producing EpiPens at a high price than you and I are for not making them at all?

The answer to this question, which involves more than just pure economic interactions, is “yes.” Beyond the relationship of supply and demand, Mylan and other producers of life-saving medicines have a moral obligation to treat consumers fairly and not take advantage of their firms’ inordinate supplier power, which far exceeds their customers’ minimal buyer power

Mylan did a noble thing in deciding to produce EpiPens; however, that choice also comes with a responsibility to treat consumers right, especially given the med market’s unique characteristics. The presence of a premier supplier with overwhelming market share discourages competitive entry into any industry. In a heavily regulated one like pharmaceuticals, where FDA approvals can take decades, those barriers to entry are even higher than usual.

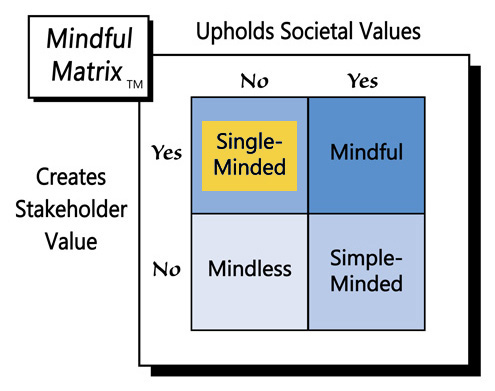

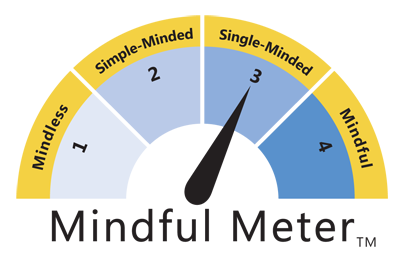

Given the very inelastic demand for epinephrine auto-injectors (consumers have to have them), Mylan’s momentous price increase will likely create stakeholder value: the company profits and people receive a life-saving device. Still, the company should not have leveraged its asymmetrical supplier power to pressure consumers to pay so much. Mylan’s methods resemble price gouging and consequently represent “Single-Minded Marketing.”

Learn more about the Mindful Matrix and Mindful Meter.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed