These latter retailers are part of the $7 billion+ rent-to-own (RTO) industry. As the name implies, such stores don’t specialize in selling products outright, like most retailers do. Instead, RTO stores allow people to pick-out the product they want along with a financing plan that involves making relatively small weekly or monthly payments over many months or even years. Customers get to start using the products immediately, but they don’t actually own them until the last payment is made. In other words, if a customer makes every payment but the last one, they can lose the product and everything they’ve paid up to that point.

In some ways RTO retailers provide a helpful service. There are times when we want use of something for a short period of time but don’t want to buy it, e.g., movies, tuxedos, carpet cleaning machines, etc. In such instances, opportunities to rent or lease can be very helpful.

There also are times when we want to own certain things, but the high cost of the items prohibits us from buying them outright, e.g., cars, houses, yachts (I have no personal experience with the last one). Again, it’s a great benefit that many organizations offer financing options in the form of rental agreements, leases, and mortgages.

RTO stores offer both of these benefits. Unfortunately, however, people who use these retailers usually end up paying many times what the products would have cost if they had saved their money and waited until they could buy them outright.

For instance, a Buddy’s flyer I came across promotes a Maytag Bravo Series washer and dryer set (MVWX655DW/MEDX655DW) that one can rent-to-own for $34.99 a week. “OWN IT IN 100 WEEKS,” the flyer exclaims. At first glance, that may sound like a good option. A family can own a high-quality washer and dryer set in a little less than two years, without needing to plunk down a large piece of cash.

Some simple math and a couple of online price comparisons, however, reveal how horrible the deal actually is. After 100 weeks, the renter will have spent $3,499 for the set. At Home Depot, what looks to be the same Maytag Bravo washing machine costs $589, and a comparable Maytag Bravo Dryer costs the same. So, that’s a total of $1,178 at Home Depot, or $2,321 less than the cost of rent-to-own through Buddy’s.

“But,” you might be thinking, “people always pay more for things when they don’t buy them outright. That’s the cost of financing a purchase, the nature of interest, and the time value of money.” Although all that’s true, people don’t usually pay such high rates on their borrowing.

Buddy’s lists the “cash price” for the Maytag washer-dryer set as $1,749.99, which is about $572 dollars more than the price through Home Depot (practically enough for another appliance); of course, the big box retailer probably can buy such manufacturer’s brands for less. Still, someone who rents-to-own the washer-dryer set through Buddy’s pays at least $1,749 dollars in interest over the life of the contract ($3,499 -$1,749.99 = $1,7490.01), or $17.49 in interest per week. That amounts to an annualized interest rate of 70.17%.

Almost anyone who hears an interest rate of 70% knows it’s extremely high, but to put it into perspective, the current rate for a 30-year fixed-rate mortgage is 3.63%; the rate for a 60-month new car loan is 4.27%; and in 2015 the average credit card interest rate was 12.09%. So, if this RTO example were classified as a loan, it would most likely be considered usury: “the illegal action or practice of lending money at unreasonably high rates of interest.”

Unfortunately, Buddy’s washer-dryer deal is not an anomaly. It’s typical of the pricing the firm offers for most of its products, including flat-screen TVs, bedroom furniture sets, sectional sofas, and laptop computers. Furthermore, Buddy’s approach is typical of the rest of the RTO industry, about which the Federal Trade Commission (FTC) says, “If monthly rental fees were expressed as an annual percentage rate (APR) they could range from about 100% to 350%.” It’s not surprising, therefore, that FTC calls RTO “A Costly Convenience.”

Nevertheless, one might argue that no one is making people rent these products. They’re entering the RTO arrangements of their own accord. If someone feels he has to have a Frigidaire 18 cu. ft. stainless steel refrigerator now, and he’s willing to pay $24.99 a week, why shouldn’t he be allowed to rent it?’

The argument for freedom of choice is somewhat compelling, but rational people also realize that what consumers want is not always what’s best for them, e.g., cigarettes, pornography, etc. Sure, an enterprising individual may start a business to sell such things, and some people will buy them, but it’s not doing them or our society any favors.

Some may also argue it’s unfair to compare refrigerators to cigarettes and porn. The latter products hurt people physically, emotionally, and socially, while a refrigerator helps us keep food cold so we can eat and live. That’s true, but anyone who ends up paying $1,874 for an appliance that should have cost about $690 has been hurt financially. Tragically, many RTO firms “specifically target low-income and minority communities”--groups that may be more susceptible to the shady pricing tactics and that can ill-afford the exorbitant financing.

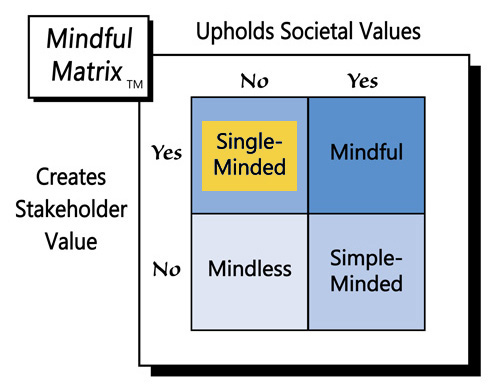

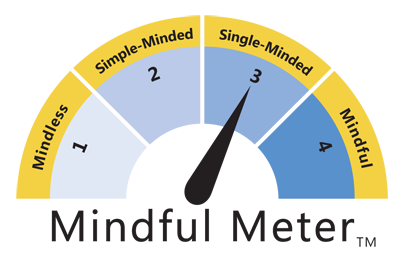

Giving consumers what they want is a good thing, provided that those desires are actually in the consumers’ best interest. Such is seldom the case, however, for RTO products. The RTO industry succeeds by preying on people who really want nice, new products, but can least afford them. A strategy that encourages vulnerable consumers to ‘get it now’ and ‘pay forever’ represents “Single-Minded Marketing."

Learn more about the Mindful Matrix and Mindful Meter.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed