Bloomburg Business has come out with “The Billionaire’s Shopping Guide: 13 Gifts for the Person Who Can Buy Anything.” As the title suggests, this gift-giving resource is aimed at helping the friends and family of the ultra-rich pick the perfect present for that person who already owns almost everything he/she needs or wants. You can read the full list with the complete descriptions, but here’s a summary:

- A Meal at Every Three Michelin Star Restaurant: $274, 983

- A 1962 Aston Martin DB4/GT: $15, 000,000 - $17,000,000

- The First Omega Speedmaster Watch: $100,000 - $150,000

- Original Art from 'Where the Wild Things Are: $200,000 - $950,000

- Rodin’s 'Eternel Printemps': $489,000 - $597,000

- Hang Out at the Edge of Space: $90,000

- A 1978 Luke Skywalker Action Figure: $12,000 - $18,000

- A Hand-Painted Dress by Holly Fowler: price upon request

- Marc Newson 'Extruded Table 3': $100,000 - $150,000

- A Wine Château in Saint-Émilion: $5,190,424

- Chalcedony Bracelets Owned by the Duchess of Windsor: $400,000 - $600,000

- The Chance to Live Like a Spy for Two Months: $11,300

- A Trek Through Untouched Rivers and Mountains in Papua New Guinea: $15,000

Although Bloomberg has compiled this list, it isn’t the one selling these items; rather they’re available through a variety of vendors, including Sotheby’s and Christies auction houses, and web-based businesses VeryFirstTo.com and TrulyExperiences.com. Another of the suppliers is luxury retailer Neiman Marcus, which curates its own unique collection of “Fantasy Gifts” that can be found within the pages of its annual Christmas Book. Here are a few of its 2015 Fantasy Gifts, which Neiman Marcus describes as “Eye-Popping, Jaw-Dropping Dreams Come True”:

- Arch Motorcycle & Ride Experience: $150,000

- World View Exploration at the Edge of Space: $90,000

- Italy Tour with Ippolita & Artemest Craftsmen: $150,000

- Neiman Marcus Limited-Edition Mustang Convertible: $95,000

- Texas Guitar Trio Gift: $30,000 each

- Couture Diary: $10,000

- His & Hers Ultimate Children’s Costumes in Mackenzie-Childs Trunks: $5,000

- 12-Day Dream Trip to India: $400,000

Can such extraordinary purchases be justified? Well, one way may be to look at them as investments. For instance, cars generally depreciate in value, but perhaps a Limited Edition Mustang Convertible will appreciate if it’s not driven but rather is garage-kept in mint condition. In that sense, buying a rare car or piece of original artwork is not unlike holding stocks with the hope of a favorable return on investment.

Most of the gifts listed above, however, aren’t items that will increase in value over time, and others aren’t physical assets at all; they’re intangible experiences. Take the Ultimate Children’s Costumes in Mackenzie-Childs Trunks. It would be cruel to buy a child that special costume she really wants, then tell her that she can’t put it on and play in it. At the same time, if she does wear Cinderella’s Ball Gown and play with the custom trunk, is it possible for her to realize $5,000 worth of benefits before becoming bored with them or outgrowing the dress? Probably not. The same is also likely true of the 12-Day Dream Trip to India. Speaking from firsthand experience, India is an incredible country that everyone should visit if they have the opportunity, but to drop almost a half million dollars on a less-than-two-week trip seems extravagant, to use an understatement.

There’s nothing inherently wrong with owing things or doing things. We need certain material goods just to function in our world, and some experiences provide real physical, emotional, and other benefits. Beyond such practical value, possessions can provide a “sense of self” as well as offer “stability and continuity in our lives” (Belk, 2011). As we grow older and wiser, though, we realize that there’s a limit to these benefits and that consuming too much of even a good thing is wasteful (Chan & Tong, 2006).

But, maybe it’s different with gifts: Don’t people appreciate expensive gifts more than less costly ones? Not according to Flynn and Adam’s (2009) study in the Journal of Experimental Social Psychology. While this research revealed that gift-givers thought their more expensive gifts would be appreciated more, gift-recipients did not make the same association. These finding are consistent with those of Richins (1994) who concluded that people ascribe value to possessions not based on their cost but on the meaning they provide. In terms of gift-giving, therefore, maybe it really is the thought that counts.

Coming full circle, it’s interesting to note that Bloomberg Business, the curator of "The Billionaire’s Shopping Guide” outlined at the onset of this post, also recently ran a piece titled “Most billionaires can’t stay that rich after 20 years.” A key statistics in the article is “of 289 billionaires in 1995, only 126 still have $1 billion.” Having money now is no guarantee that one will have money in the future. So, maybe even a billionaire would be better off with a gift that’s low on cost and high on sentimental value.

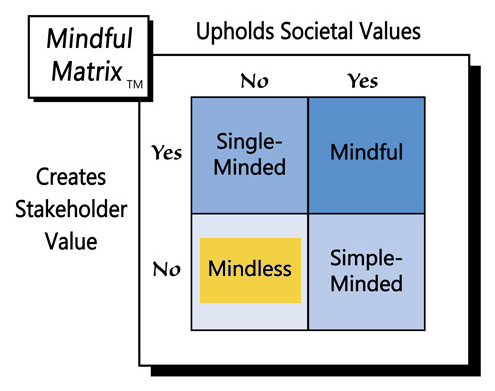

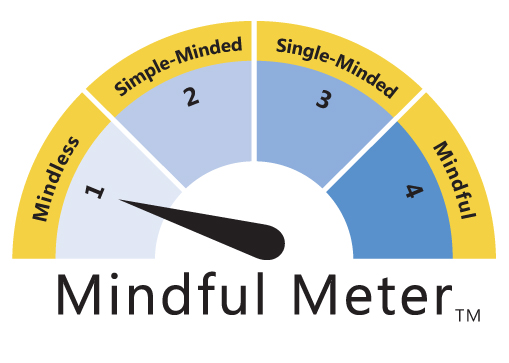

Do ultra-luxury retailers like Neiman Marcus create stakeholder value? If they sell the extravagances they advertise, they undoubtedly make money, but as discussed above, it’s questionable whether their customers reap proportional benefits. In fact, an even better question might be “At what point does one stop owning such expensive possessions and they start owning you? Furthermore, as we become more aware of the negative impact that the overconsumption of a few has on the rest of our world, it becomes apparent that such extreme indulgence doesn’t represent good stewardship, rather it symbolizes “Mindless Marketing.”

Learn more about the Mindful Matrix and Mindful Meter.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed