author of Honorable Influence - founder of Mindful Marketing

Babe Ruth promoted tobacco products. Doris Day endorsed a steamroller. George Foreman may be better known for his namesake grills than for his storied boxing career. Over the past couple of years, many celebrities inked endorsement deals in the new and fast-growing realm of cryptocurrency. Those who have attached their names to the digital dinero include:

- UFC superstar Connor McGregor with Tiger.Trade

- Tennis great Maria Sharapova with MoonPay

- Rapper Snoop Dog with a variety of crypto exchanges

- Actor Matt Damon with Crypto.com

However, probably the most infamous crypto partnerships have been between the now bankrupt Bahamas-based cryptocurrency exchange FTX and a lineup of all-star athletes and A-List celebrities, including: Tom Brady, Gisele Bündchen, Stephen Curry, Kevin O’Leary, and Naomi Osaka.

Even when products have little connection to celebrities’ specific talents, star-studded endorsements are often very effective for a few reasons:

- Celebrities grab attention. If you’ve ever seen a celebrity in an airport or walking down a city street, you probably watched them for at least for a moment.

- Individuals are very interested in the lives of famous people and those who know them. That’s why there are crowds of royal watchers and television shows like Basketball Wives.

- People often want to pattern their lives after those of celebrities. Gatorade famously capitalized on that inclination a few decades ago with its “Be Like Mike” ad campaign, and most other celebrity-based promotion includes a similar inference – if you buy this product, you’ll be at least a little like the star who’s selling it.

While I know a little about advertising endorsements, investing and cryptocurrency are not my wheelhouse, which led me to reach out to two colleagues who have both that skill set and knowledge. I asked each to share his thoughts about celebrities endorsing financial products.

Jansen Hein, is the chief financial officer and chief operating officer at Illinois State Board of Investment (ISBI) where he actively manages all portfolio operations, business operations, and finance/accounting related functions and processes for ISBI, a $24B+ state pension asset investment agency. Before joining ISBI, he served as a certified public accountant and consultant for more than eight years with Ernst & Young.

Dwayne Safer is a finance professor at Messiah University where he teaches courses in Financial Management, Corporate Finance, Security Analysis and Evaluation, Financial Institutions Management, and Investments. He holds the designations of CFA, CFP, and CAIA. Before entering higher education, he was a senior vice president of corporate strategy & development for Citizen’s Financial Group and a director of investment banking at Stifel Financial Corp.

As their brief bios suggest, both men have extensive financial backgrounds that make them well-qualified to discuss what constitutes reliable investment advice, as well as who should offer it. Given those credentials, I was somewhat surprised that in their initial responses, neither expressed absolute objection to celebrities endorsing financial products:

Hein: “An ethically run business could see benefit from getting their message/product out through the use of celebrity endorsements, and I have no issue with that.”

Safer: “I don’t have a problem with celebrity endorsers of financial products and companies; however, the public oftentimes has difficulty separating the popularity and likability of the celebrity personality from their lack of expertise and knowledge in the company or product they’re endorsing.”

While both of these experts are open to the possibility of celebrities endorsing financial products, the preceding qualified responses foreshadow their more fully articulated beliefs, which detail significant criteria to meet in order for such sponsorships to be good for consumers. Together they construct three main hurdles that effective and ethical financial product purveyors must clear:

1) Transparency

To illustrate what celebrity spokespeople shouldn’t do, Safer references the recent case in which the SEC fined Kim Kardashian $1.26 million for her failure to disclose that EthereumMax paid her $250,000 to promote EMAX tokens on her Instagram account. He contrasts her incomplete communication with that of Barstool Sports founder Dave Portnoy, who was upfront that he received an ownership stake in the ETF BUZZ in return for promoting it in his tweets.

Safer similarly contends that organizations must be transparent in terms of whether they are investing individuals’ money, like mutual funds, ETF’s, and hedge funds do, versus simply serving as custodians of those funds, like brokerage firms and banks often do. As an example, he points to FTX, whose clients thought the exchange was only acting as a custodian of their money, when in reality it was investing it in a crypto hedge fund of a sister company, Alameda.

2) Trust

That kind of transparency is key to earning investors’ trust, as Hein shares: “To me, decisions regarding financial services providers must come down to personal trust. Regardless of the product/provider.” He adds that although he is not personally inclined to extend such trust for financial decisions to celebrities, he recognizes that some consumers are, in which case they must understand and accept the risks, while the celebrities and the businesses that employ them are culpable for any deception, intentional or not.

Hein believes that trust of service providers is especially important in the case of investing because laws often lag behind industry practices, legal enforcement is sometimes lax, and many organizations simply choose not to self-regulate. He also emphasizes how the unique nature of investment risk necessitates more than typical trust:

“We are not talking about buying a $100 product, with limited downside, but about investing in ways that may materially impact a consumer's current and future stability. The scrutiny of consumers should be different for any financial services marketing than for other products.”

Safer also underscores consumers’ responsibility for determining who to trust, referencing FTX and suggesting that the exchange’s use of a large number of high-profile “finfluencers,” e.g., Kevin O’Leary and Larry David, appeared to be “a ploy to engender the trust of the public so that they would invest in the growing crypto craze through FTX without doing basic diligence on the company.”

3) Technical Competence

Deciding who to trust is an age-old social challenge that extends far beyond investment relationships. The character of the other person is certainly one of the main trust criteria. Another is their competence, i.e., Are they able to do what their role in the relationship requires?

In the case of celebrities promoting investments, their financial competence is a very legitimate question. It’s not surprising that both Hein and Safer, whose extensive experience and education have provided them with such expertise, wonder whether most celebrities know what’s needed to competently endorse financial products. The two agree that, unfortunately, celebrities’ popularity often appears to be more persuasive to consumers than any financial proficiency they may possess:

Hein says, “Consumers must accept that their willingness to be persuaded to make financial transactions based on a celebrity endorsement may have little/no meaningful merit on the quality of the product or service. Is Steph Curry a financial professional? Is Kim Kardashian an investment professional? I am not saying that these two individuals are foolish or unwise (both are extremely successful at their crafts/professions).”

He continues, “What I am suggesting is that it is very possible that either (1) they are making these endorsement determinations themselves and we must acknowledge their limitations in doing so or (2) they themselves are relying on the advice of other financial professionals regarding the products/companies they choose to endorse — individuals we as general consumers do not know or necessarily trust.”

As shared above, Safer says he has no problem with celebrities endorsing investments, but he is concerned that “the public oftentimes has difficulty separating the popularity and likability of the celebrity personality from their lack of expertise and knowledge in the company or product they’re endorsing.”

He expands that belief with a more specific example: “I may think Tom Brady is the best QB of all time, but I’m pretty sure he knows very little about crypto and how crypto assets should have been custodied at FTX. In fact, he’s likely just collecting a big check from FTX and not caring about the details.”

Should celebrities endorse financial products? Neither Hein nor Safer offer an unequivocal, “No,” but together they use the tools of transparency, trust, and technical skills to paint an exacting picture of investment advice done right that’s undoubtedly very challenging for most famous spokespeople and their firms to replicate.

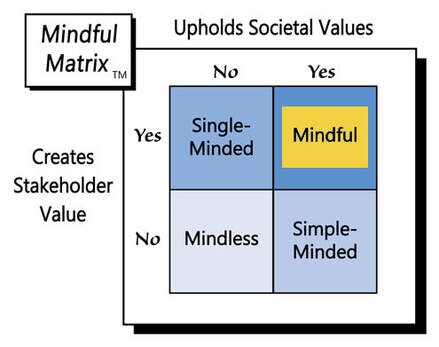

However, in the rare cases in which such a portrait can be perfected, celebrity investment endorsers can play a supporting role to “Mindful Marketing.”

Learn more about the Mindful Matrix.

Check out Mindful Marketing Ads and Vote your Mind!

RSS Feed

RSS Feed